Emergency prep

Stock up on crucial emergency supplies tax-free across Texas this weekend

The scourge of Winter Storm Uri is a brutal reminder for Texans to be prepared for the most extreme weather — and subsequent power outages. An upcoming "sales tax holiday" can help.

From 12:01 am Saturday, April 24 through midnight Monday, April 26, shoppers can purchase certain emergency supplies tax-free — including coveted generators (up to a certain price point) — as part of the 2021 Emergency Preparation Supplies Sales Tax Holiday, the Texas Comptroller’s Office says.

Here is a breakdown of equipment and supplies eligible for the tax break:

Less than $3,000

- Portable generators

Less than $300

- Emergency ladders

- Hurricane shutters

Less than $75

- Axes

- Batteries, single or multipack (AAA cell, AA cell, C cell, D cell, 6 volt or 9 volt)

- Can openers — nonelectric

- Carbon monoxide detectors

- Coolers and ice chests for food storage – nonelectric

- Fire extinguishers

- First aid kits

- Fuel containers

- Ground anchor systems and tie-down kits

- Hatchets

- Ice products — reusable and artificial

- Light sources — portable self-powered (including battery operated)

- Examples of items include: candles, flashlights and lanterns

- Mobile telephone batteries and mobile telephone chargers

- Radios — portable self-powered (including battery operated) — includes two-way and weather band radios

- Smoke detectors

- Tarps and other plastic sheeting

Notably, protective items such as face masks, gloves, and other pieces of personal protection equipment do not qualify for the exemption. Neither does toilet paper.

Shoppers who aren’t looking forward to braving long lines are in luck: products bought online, by phone, mail, or custom order also qualify for the exemption, the comptroller’s office says. There is no limit on the number of qualifying items that may be purchased.

A full list of what is and is not covered under the law can be found here; additional information is available via phone at 1-800-252-5555.

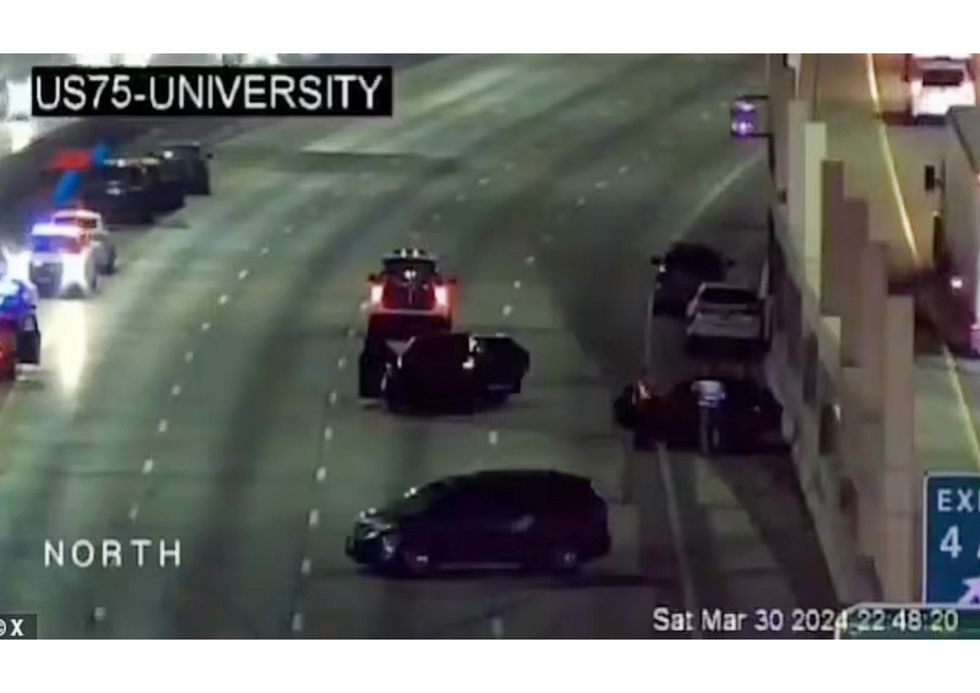

Footage of the aftermath following an accident on US-75TxDOT

Footage of the aftermath following an accident on US-75TxDOT