Real estate report

Fort Worth home prices surge with one of the biggest jumps in U.S.

If you think Fort Worth is a buyer's market, think again. Fort Worth home prices have increased tremendously in recent years, outpacing every other major Texas metro — and most major housing markets on the continent, according to a new report.

Canadian real estate news site Point2 Homes reports that 18 out of the 83 largest North American housing markets experienced home prices grow by more than 50 percent from December 2013 to December 2018, and Fort Worth is in that exclusive group.

The median home price in Fort Worth — ranked No. 10 in the U.S. and No. 16 in North America — surged from $148,000 in December 2013 to $225,000 in December 2018, a 52 percent increase. Other large markets in Texas didn't come close.

Nearby Dallas had the second-lowest home price growth among the Texas cities studied, with a median home price increase of 24 percent (from $229,900 to$285,000). At 12 percent, El Paso had the lowest median home price growth in the state.

Austin's median home price grew 33 percent, from $226,000 to$301,391, and San Antonio saw a similar gain of 32 percent ($171,400 to$226,200). Houston home prices jumped 27 percent, going from $188,500 to$240,000.

Detroit topped the North America list with a surprising 97 percent increase in home prices over the last five years but a net increase of only $30,143. San Francisco, however, saw the highest net increase, a staggering $550,000.

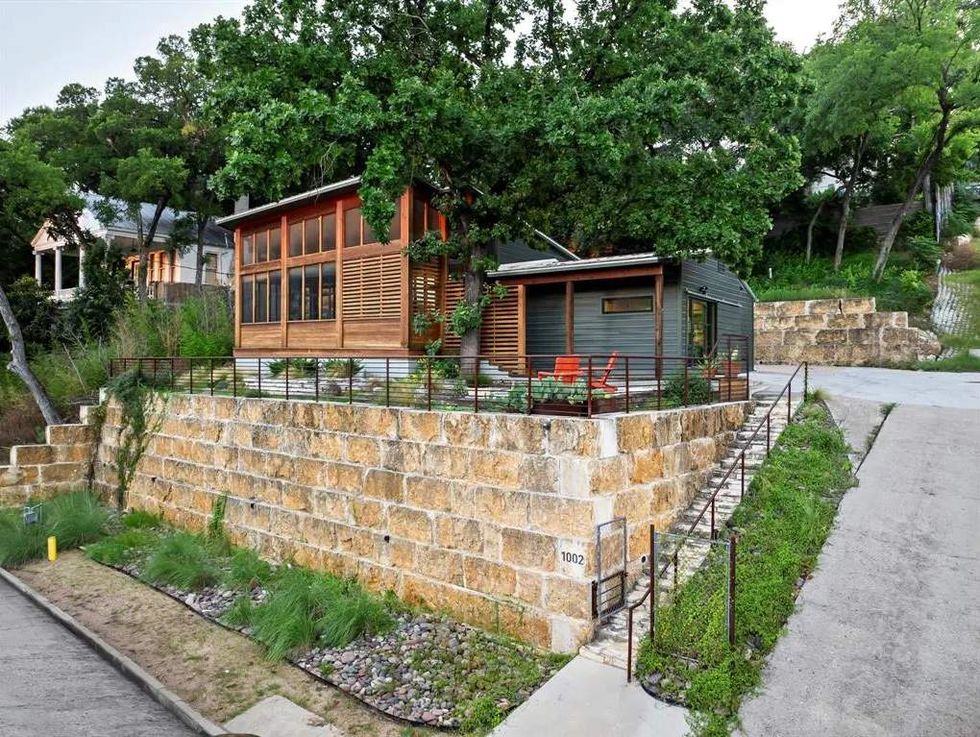

1002 Baylor Street is on the market for $1.65 million.Photo courtesy of James H Ruiz Photography

1002 Baylor Street is on the market for $1.65 million.Photo courtesy of James H Ruiz Photography