Homeowner News

Tarrant County tax office issues reminder about looming property taxes

Deadline is coming up.

The Tarrant County Tax Office has a reminder for homeowners: The last day to pay property taxes for 2023 and avoid penalty and interest is Wednesday January 31.

Tarrant County Tax Assessor-Collector Wendy Burgess recommends not waiting until the last minute and maybe do it online.

“All eight of the Tarrant County Tax Office locations are open Monday through Friday from 8 am-4:30 pm to assist taxpayers with their property tax payments, but we encourage taxpayers to pay online whenever possible to avoid the crowds," Burgess says in a statement. “As online systems become heavily used in the last hour of the day, we recommend you start the online process earlier in the month to avoid complications and not waiting until January 31. Please plan around inclement weather and other emergencies if you intend to pay in person.”

There is no provision in the Tax Code for a delayed payment or extended due date due to inclement weather conditions or other emergencies.

Property taxes can be paid online at https://taxonline.tarrantcounty.com/TaxPayer with a credit card, although a convenience fee is added. Online e-Check payments can be made with no additional convenience fee. Pay-by-phone is available 24/7 at 817-884-1110.

Payments made by mail are posted according to the US Postal Service postmark date and must be postmarked by January 31.

Online and phone payments must be completed by 11:59 p.m. Central Standard Time on January 31. Incomplete and pending payments completed at or after midnight Central Standard Time on February 1 will be posted accordingly.

Burgess says they'll accept partial payments, but the remaining balance will still be subject to penalties. Boo.

The Tarrant County Tax Office Customer Service Center is available at 817-884-1100 to assist citizens with property tax and motor vehicle questions.

Phone lines are open Monday-Friday from 8 am-4:30 pm, but they'll have extended hours until 7 pm on January 29, 30, and 31.

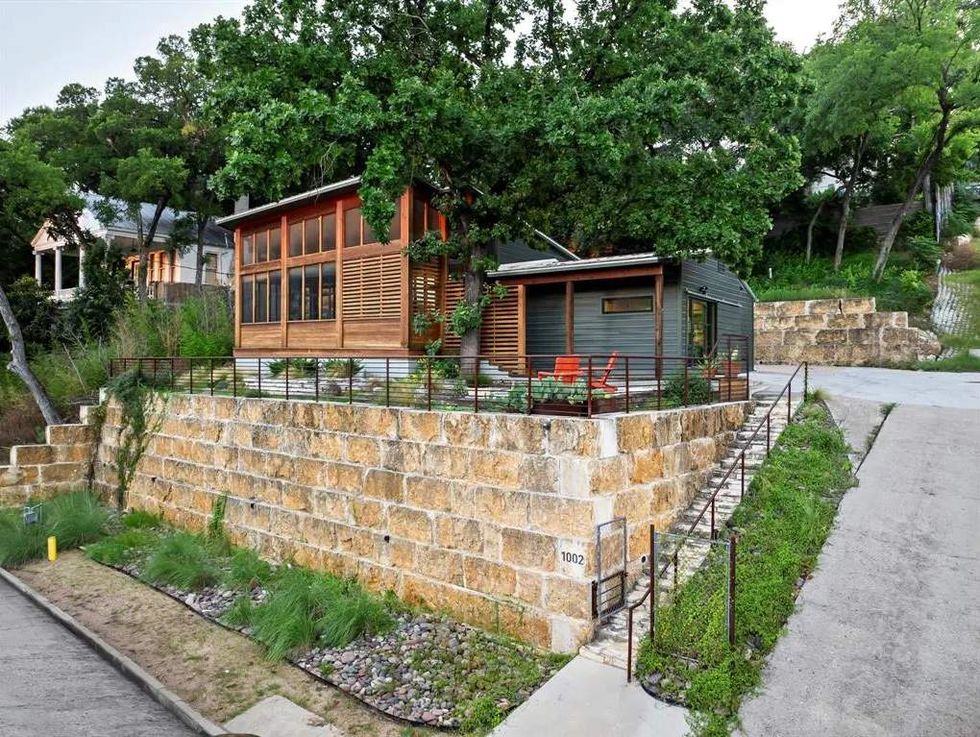

1002 Baylor Street is on the market for $1.65 million.Photo courtesy of James H Ruiz Photography

1002 Baylor Street is on the market for $1.65 million.Photo courtesy of James H Ruiz Photography